28 Jun Splitting Hairs…FICO vs. Credit Score

Raise one hand if you’ve heard the term “Credit Score” before. Raise the other hand if you’ve ever heard the word “FICO”. If you have both hands in the air, you are very good at following directions! A little humor is good for the soul. But, misunderstanding and underestimating the value of a good credit score is no laughing matter. In fact, FICO scores are used in more than 90% of lending decisions as the standard credit score in the U.S. So what IS it!? A credit score is a numerical summary of the information on your credit bureau report. The Fair Isaac Corporation (FICO) is the largest and most well known company providing the software used to calculate a person’s credit score.

The two terms, credit score and FICO score, are often used interchangeably. For all intents and purposes, they are essentially synonymous. They both represent the same three digit number, ranging from 300-850. This number is used to determine projected risk and the likelihood of delinquency within a two year time frame. Trans Union, Equifax, and Experian are the three leading credit reporting bureaus. These agencies assign credit scores based on the information they receive from banks, credit card companies, lenders, utility companies, as well as other financial institutions and merchants. As a result, each person has three scores, one for each of the major credit bureaus. These scores may differ somewhat depending on the information each bureau receives.

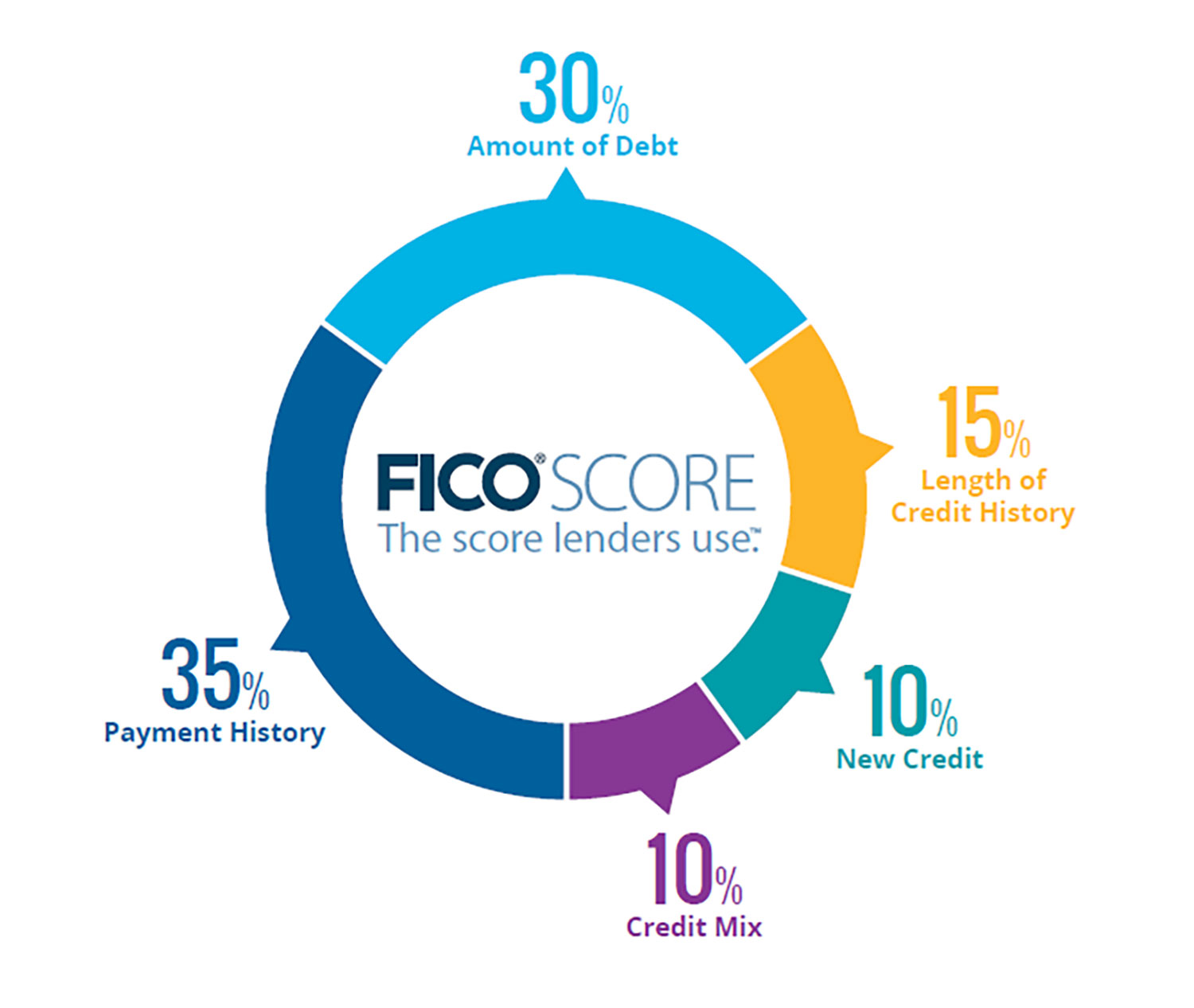

There are five major categories that make up a FICO score, however, each factor is weighted differently. Payment history has the greatest impact on one’s score and is determined by whether or not a person pays their bills on time. Because this category is weighted heaviest, late payments can have a big negative impact on FICO scores. Amounts owed refers to the amount of money a person has borrowed and needs to repay. This includes any debt such as credit cards, department or other store cards, vehicle, home, private and other types of loans. Length of credit history is based on how long a consumer has been using credit. The gist of this category is the longer the credit history, the lesser the perceived risk or likelihood of delinquency. New credit and types of credit are weighted the same and the least of the five categories. “New” refers to newly established credit and “Types” refers to the most commonly used types of credit accounts.

Of all the information that falls within the five categories mentioned above it may seem nearly impossible to keep any information private. Nevertheless, there are some things that will NOT appear on your credit report or affect your FICO scores.

- The Equal Credit Opportunity Act ensures that information specifically identifying race, color, religion, national origin, sex, or marital status is not listed.

- Age is not listed.

- Past or present salary details, occupation, title, employer, date employed, and employment history are not listed.

- Interest rates on credit cards or other accounts currently held are not listed.

- Child or family support obligations are not listed.

- Certain types of inquiries such as you checking your own credit for monitoring purposes, promotional inquiries for “pre-approval”, administrative inquiries such as when a lender reviews the account you currently hold with them, and requests marked as coming from an insurance company or employer are not listed.

- Whether or not you are participating in credit counseling of any kind is not listed.

These items are omitted from your credit report for your protection and freedom. FICO scores are calculated based only on the information on your credit report. This is why regular and consistent monitoring of your credit is so important.

No Comments