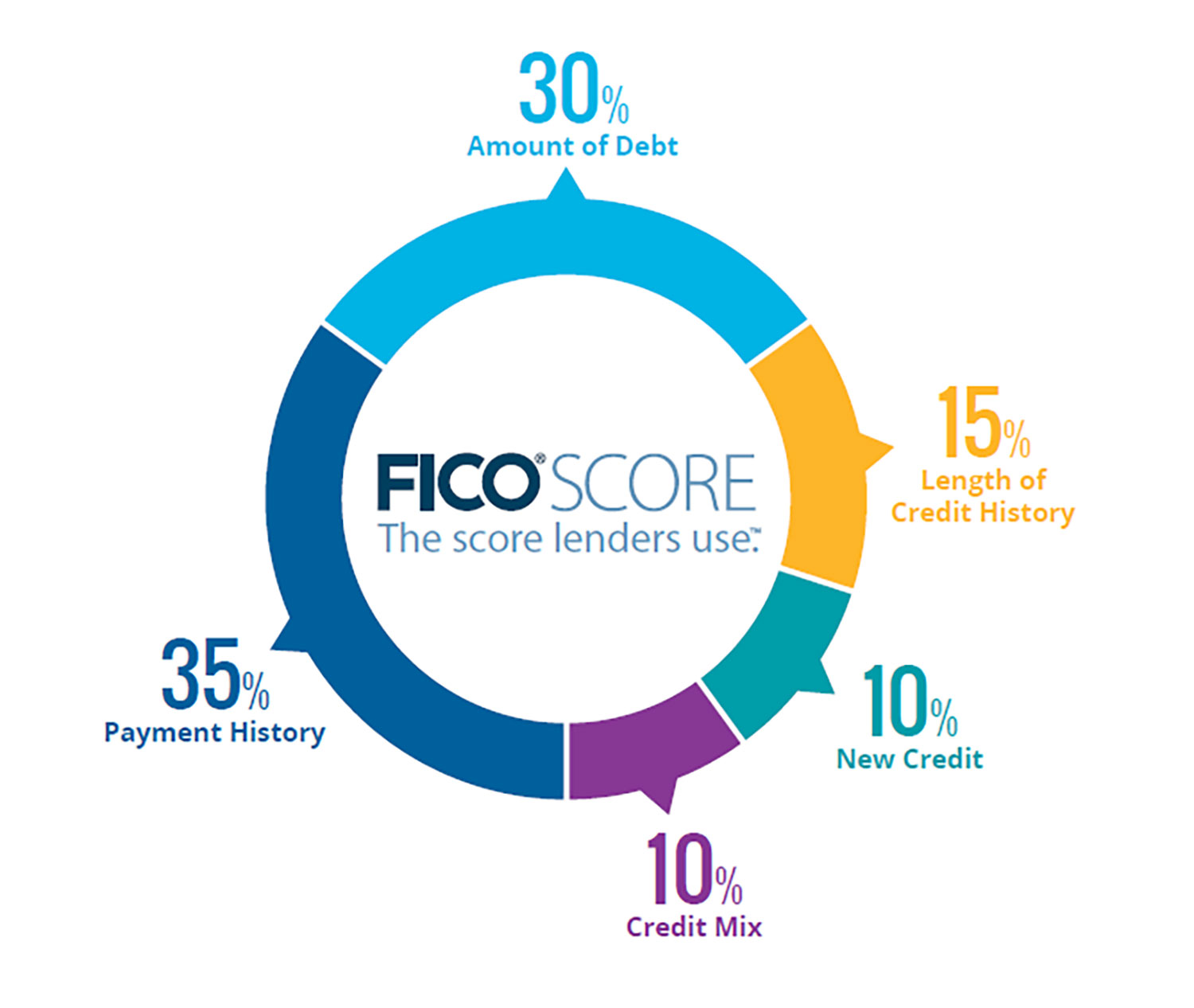

12 Sep Know Your Credit Status

Maintaining a high credit score is the best way to get what you want or need without having the cash immediately available. If we're honest with ourselves, there have been times when we've all wanted something we couldn't actually afford to purchase outright. This is where...