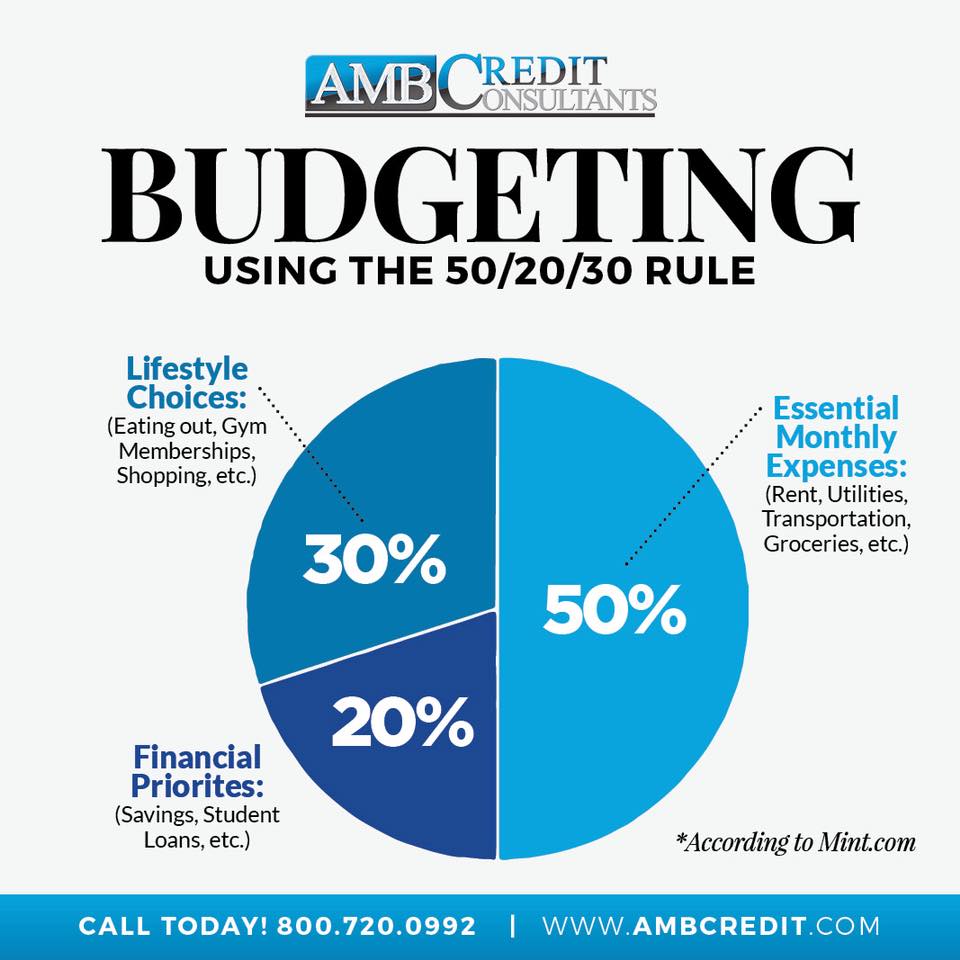

05 Sep A New Way To Budget! Budgeting Using The 50/30/20 Rule. Copy

Budgets are more than just paying your bills on time…a budget is also about determining how much you should be spending and on what. The 50/20/30 rule, also called the 50/30/20 budget, is a proportional guideline that can help you keep your spending in alignment with your savings goals.

![]() 🔹50% of Your Income – Essentials

🔹50% of Your Income – Essentials

To begin abiding by this rule, set aside no more than half of your income for the absolute necessities in your life. This might seem like a high percentage (and, at 50 percent, it is), but once you consider everything that falls into this category it begins to make a bit more sense

![]() 🔹20% of Your Income – Savings

🔹20% of Your Income – Savings

The next step is to dedicate 20 percent of your take-home pay toward savings. This includes savings plans, debt payments and rainy-day funds—things you should add to, but which wouldn’t endanger your life or leave you homeless if you didn’t. That’s a bit of an oversimplification, but hopefully you get the gist. This category of expenses should only be paid after your essentials are already taken care of and before you even think about anything in the last category of personal spending.

![]() 🔹30% of Your Income – Personal

🔹30% of Your Income – Personal

The last category, and the one that can make the most difference in your budget, is unnecessary expenses that enhance your lifestyle. Some financial experts consider this category completely discretionary, but in modern society, many of these so-called luxuries have taken on more of a mandatory status. It all depends on what you want out of life, and what you’re willing to sacrifice. The reason that this category accounts for a larger percentage than your savings is because so many things falls into it.

Source: Mint Life

No Comments